Quick money can be demonstrated responsible financial choices and may even replace your credit history over the years. Of the sensibly controlling the loan, you can make a plan into the rebuilding your own borrowing and you can expanding the future borrowing from the bank solutions.

Brief Acceptance Procedure: Environmentally friendly Tree Financial Cellular House provides a quick recognition processes, have a tendency to making decisions within this period from receiving a credit card applicatoin. This enables those with immediate financial has to availability loans promptly, though he has poor credit. The new brief recognition techniques means you could potentially target immediate costs otherwise monetary issues in the place of too many delays.

Financial assistance If needed: Eco-friendly Forest Economic Cellular Residential property knows that those with bad credit might still feel unexpected expenditures or brief bucks shortages. By providing cash advance, they provide an answer just in case you need immediate financial help. Whether it’s to own expense, issues, and other pressing need, Eco-friendly Tree Monetary Mobile Land may help link the fresh new pit up to your following salary.

Consider, while Green Tree Financial Cellular House is available for individuals that have poor credit, its vital to borrow sensibly and ensure you could comfortably pay the borrowed funds according to the conformed-up on terms. This will not only meet your financial personal debt and in addition lead so you can boosting your creditworthiness throughout the years.

Non-Judgmental Method: At Eco-friendly Tree Economic Mobile Property, we know that financial hardships can happen to help you somebody. We approach all loan application having sympathy and value, no matter what your credit history. Our company is here to navigate your financial pressures and you will offer feasible loan alternatives.

Building Faith and you will Dating: I worthy of our very own people and endeavor to build a lot of time-identity relationships considering faith and transparency. Our solution was purchased letting you on the borrowing from the bank procedure, responding the questions you have, and you can delivering advice when needed.

Increased Economic Potential: From the going for Green Forest Economic Mobile Residential property and you may responsibly handling the mortgage, you can replace your finances through the years. Since your creditworthiness grows, you can also access more good mortgage words and other monetary possibilities in the future.

Don’t allow bad credit or no borrowing from the bank keep your right back. Demand that loan out-of Environmentally friendly Tree Economic Mobile Homes and take one step into the improving your finances. Head to the site from the greentreesloans to begin with the program processes. All of our affiliate-friendly software and you can services are quite ready to assist you in securing the funds need, despite your credit report. Believe Environmentally friendly Tree Economic Cellular Home getting inclusive, credible, and you can customer-centric lending possibilities.

Green Forest Financial Mobile Homes aims to become a reliable lover from inside the getting legitimate and you will productive financing selection. Whether you are up against unanticipated expenditures, short term cash shortages, or urgent economic demands, Environmentally friendly Forest Monetary Mobile Land strives to provide accessible financial assistance when you need it most.

Please be aware it is vital that you obtain sensibly and make certain one you might comfortably pay back the loan with regards to the arranged-up on terms and conditions. Carefully comment this new fine print, including the Annual percentage rate, and work out an informed choice one aligns with your finances and needs.

Many thanks for provided Environmentally friendly Forest Economic Mobile Homes since your economic supplier. We look forward to assisting you to and you will providing you with brand new funding you’re looking for.

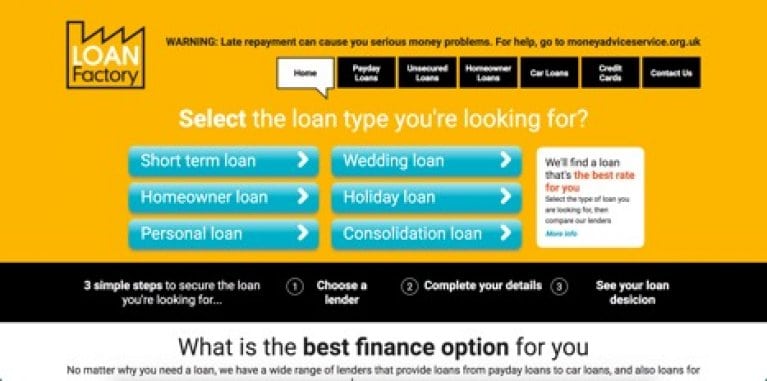

This website isnt an offer to help you provide. greentreesloans Morgan Heights loans is not a loan provider otherwise lending mate and won’t generate financing otherwise borrowing conclusion. greentreesloans connects interested people with a lender otherwise credit spouse out of the system from acknowledged lenders and you may lending couples. greentreesloans does not manage and is perhaps not accountable for the actions otherwise inactions of any lender or lending mate, is not a representative, representative otherwise representative of any bank otherwise lending mate, and won’t endorse people bank or lending mate. greentreesloans get settlement from the lenders and you may credit lovers, have a tendency to based on a great ping-tree model just like Bing AdWords where in actuality the highest offered bidder is actually linked to the user. Regardless of, greentreesloans’s services is often free to your. Sometimes, you will be given the option of obtaining that loan off an effective tribal lender. Tribal lenders is susceptible to tribal and you will certain government legislation while you are are immune off state law plus usury hats. When you’re connected to a beneficial tribal lender, please understand that the fresh new tribal lender’s costs and you can charges may be higher than state-signed up loan providers. Simultaneously, tribal loan providers may require that invest in manage one conflicts for the a good tribal legislation. You are advised to learn and you may comprehend the terms of one financing supplied by people bank, whether tribal or county-licensed, and deny any sort of financing promote that you cannot afford to settle otherwise including terms that aren’t appropriate so you can your.