An authorities unsecured loan strategy is a type of consumer loan specifically made getting main and local government group. Authorities employees can apply because of it system to look at abrupt monetary emergencies. If you are a government staff member, you can take personal loans to ?forty lakh at the interest levels including 8% p.a beneficial. for a tenure as much as 7 years.

This web site talks about all you need to understand a great government unsecured loan program, together with interest rates, fees, qualification and you can files necessary.

You don’t need to lose on the fantasy matrimony otherwise vacation. Submit an application for instantaneous consumer loan for relationships with no inhibitions.

Fed up with postponing your trip for some time because of diminished loans? Submit an application for immediate unsecured loan to own take a trip and arrange for your travels now!

Which have a vehicle produces driving much easier. Sign up for a simple unsecured loan to own vehicle and you may take a trip everywhere in the otherwise out of your city challenge-100 % free.

But if you’ve planned to find a bike but don’t enjoys sufficient fund to make the downpayment, you can take an unsecured loan for 2 wheeler. See versatile repayment selection and you can attractive rates of interest.

Shedding lacking finance purchasing one minute-hand bicycle? Need an unsecured loan and get another-give bicycle with just minimal paperwork and enjoy the joyride.

Maybe not likely to greatly invest in a different automobile? Purchase one minute-give car. However, if you will be dropping quick to the fund, get a consumer loan to have car or truck. Appreciate instantaneous disbursal with minimal paperwork.

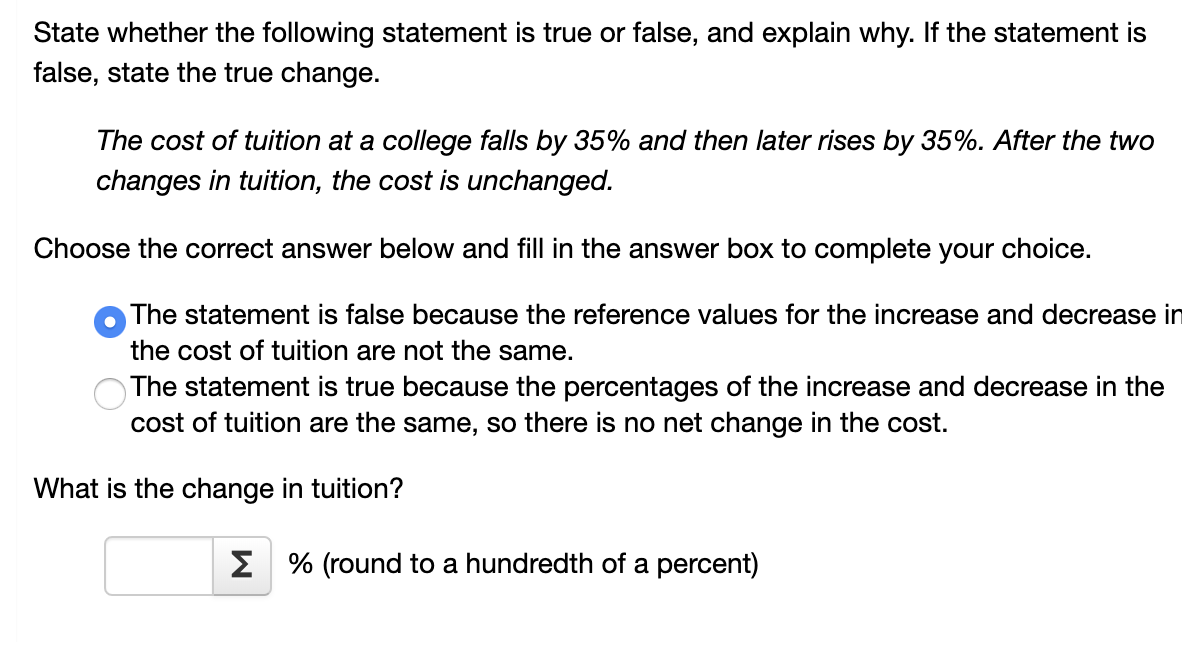

Bodies consumer loan schemes are just like any almost every other private financing. not, certain lenders offer down interest rates, quicker processing charges, etcetera., needless to say kinds of authorities group.

Want fast access to help you cash? Get Navi Cash advance and just have immediate access so you’re able to financing all the way to ?20 lakh. Find the repayment period depending on your choice and you can pay-off into the easy EMIs. Obtain the newest Navi software now!

Ans: Allow me to share specific additional costs for an unsecured loan:step 1. Handling charges: Usually step 1-3% payable to own processing a credit card applicatoin.2. Financing termination costs: Charge start around one lender to another3. Prepayment charges: 2%-5% of one’s a fantastic mortgage amount4. EMI payment jump charge: Of Rs. three hundred to help you Rs. five-hundred to your inability away from deduction regarding specified EMI

Ans: Whenever availing out-of an unsecured loan, you should manage a credit score of at least 750 whilst determines their creditworthiness and you will, therefore, the probability of loan fees. A lowered credit rating signifies bad personal debt management, that will end in large interest rates applicable on your loan otherwise downright getting rejected.

Ans: Salaried team must have a routine revenue stream and be employed for at least 6 months to apply for an excellent consumer loan. Most loan providers offer a loan amount about what EMIs usually perhaps not go beyond 40-50% of one’s month-to-month income.

Ans: Unsecured loans constantly include short tenures because they are suggested as reduced when you look at the a short period. Within the India, unsecured loans have a tenure regarding several to help you 60 days, though some loan providers offer versatile tenures as high as 84 days.

Ans: Of several moms and dads simply take a consumer loan for their kids’ training because they frequently feel the economic stability to find a loan approved. Due to the fact child completes their/their degree and you will gets employed, the borrowed funds should be moved getting him/their particular to invest.

Ans: In typical items, really financial institutions disburse the mortgage number in 24 hours or less out-of acceptance. The true amount borrowed that you’ll discover depends on the fresh conditions and loans West Goshen terms of mortgage arrangement.