That it foreclosure step issues a great $3,000,000 financing expanded so you can defendant Vincent Roggio towards , from the Arizona Mutual Financial, N.A good. (Washington Mutual), a today defunct lender. Defendant argued before the trial judge that JPMorgan Pursue, Letter. Defendant now appeals regarding the buy inserted because of the trial judge on the , doubt his actions to help you write off this task for insufficient reputation. We affirm.

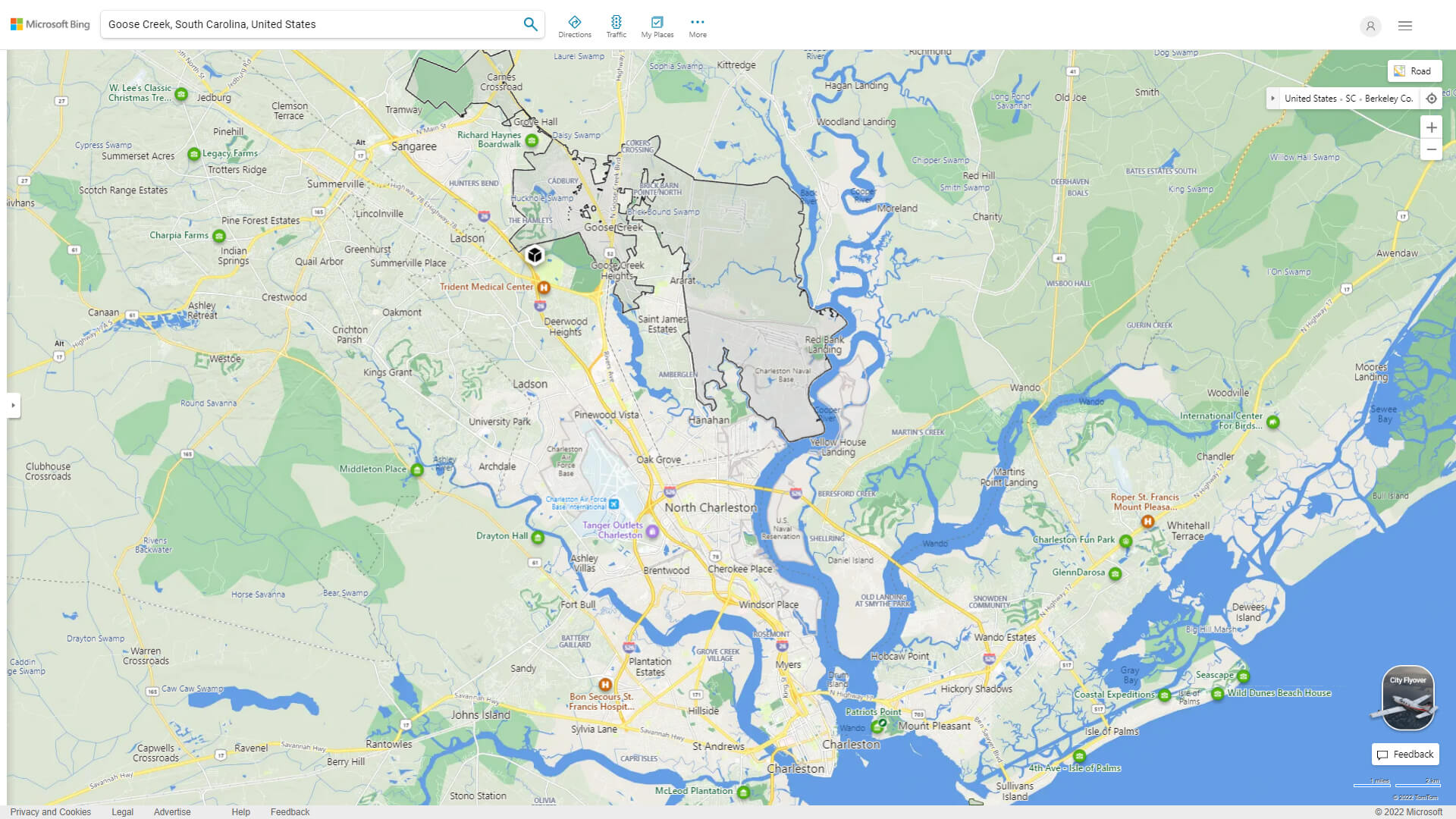

Into the , accused executed good promissory notice in support of Washington Mutual to help you file this new terms of payment away from a $step 3,000,000 loan accused acquired regarding the bank. To secure the loan, accused carried out a companion financial with the real property he owned from inside the Red-colored Financial. Accused defaulted to your financing almost immediately, however, ultimately causing Washington Mutual in order to file a property foreclosure ailment up against him towards the . Centered on accused, he withheld payments owed to your mortgage pursuant to a binding agreement achieved with Arizona Mutual just like the lender had busted his borrowing get because of the submitting a too high number of credit questions.

Defendant submitted a pro se treatment for brand new foreclosures step to your , inducing the circumstances are detailed just like the a competitive matter for the the latest Monmouth State vicinage. The brand new people afterwards achieved a contract in addition to instance are noted compensated. This new terms of the new payment was in fact put-on the listing before the latest Chancery Section, General Guarantee Area within the Monmouth County into .

PLAINTIFF’S The advice: [T]the guy settlement will bring one Arizona Shared will need steps to correct one wrong reporting for the Mr. Roggio’s borrowing, while having take-all strategies it is possible to to eradicate multiple issues out-of the new declaration, since the multiple issues will bring the financing score off.

Reciprocally, Mr. Roggio has decided you to their contesting answer, separate protections is taken. Therefore the document is gone out of Your own Honor’s docket straight back towards Property foreclosure Equipment in Trenton so you can just do it since uncontested. Nevertheless might possibly be lived-in Trenton to possess a time period of 90 days from the time plaintiff directs out the credit scoring modification.

New Judge: The things i make the genuine issue here’s [] that once the financing rating are brought up to price, that Mr. Roggio seems which he can be refinance or take your out, and is exactly what the bundle try, proper?

MR. payday loan Ridgebury ROGGIO: Legal, my question, the newest caveat, with this specific would be the fact indeed the fresh inquiry top and you may what, despite Arizona Mutual’s most readily useful intentions, the financing bureaus commonly participants [sic]. This is why while i believed to which gentleman, that it needs to be ever since they actually clear it up. This basically means, I want 60 days regarding you to definitely day therefore the bank — the bank doesn’t need a letter. The bank’s already told you, we are going to take action.

PLAINTIFF’S Counsel: There can be yet another identity I didn’t can, The Award, and that’s Mr. Roggio enjoys concurred, he’ll work with a credit file inside the forty five days and supply an excellent backup for me to make sure that we are able to find out if — we have zero manage when we send it into the borrowing agencies their work inside. Very he’s going to work with research, publish they if you ask me.

The latest Judge: Sure. Really, you do have specific control because if the financing declaration immediately following 45 months does not reflect just what you thought to them, then you can log on to them and you can do this.